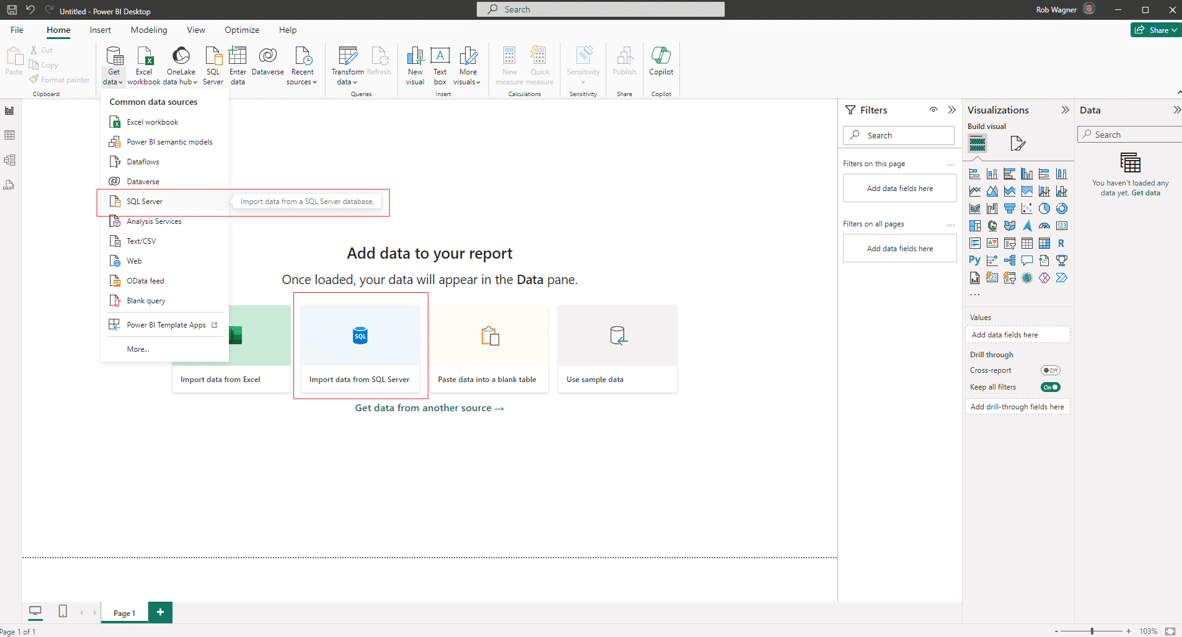

Transform Dynamics GP Data into Actionable Intelligence with Power BI

Creating actionable intelligence from your Dynamics GP data can be accomplished with the robust features and functionalities in Power BI. […]

Creating actionable intelligence from your Dynamics GP data can be accomplished with the robust features and functionalities in Power BI. […]

Finding a partner who can help you navigate Dynamics 365 licensing will help you make sense of the various options […]

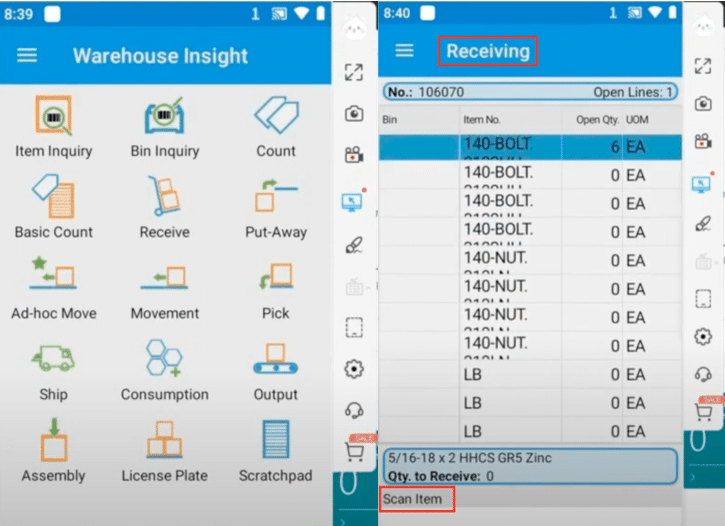

Efficient and effective distribution operations in today’s technology-driven environment hinge on fully harnessing the available capabilities of your software and […]

Navigating the distribution operations landscape requires precision and effective tools. Dynamics 365 Business Central offers a comprehensive suite of features […]

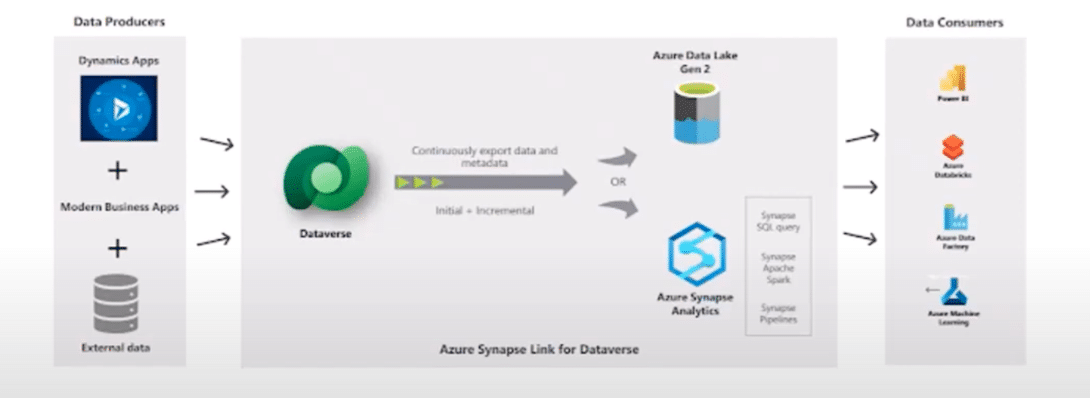

With news that Microsoft is deprecating Export to Data Lake, a popular upgrade to replace this system has emerged in […]

Enterprise resource planning (ERP) is a system that integrates various business processes and functions into a single platform. ERP implementation […]

For nonprofits and nongovernmental organizations (NGOs) navigating grants and awards, selecting the right software is paramount to efficient fund management. […]

Microsoft has launched a new range of commercial Microsoft 365 and Office 365 plans that exclude Teams, called “(no Teams)”. […]

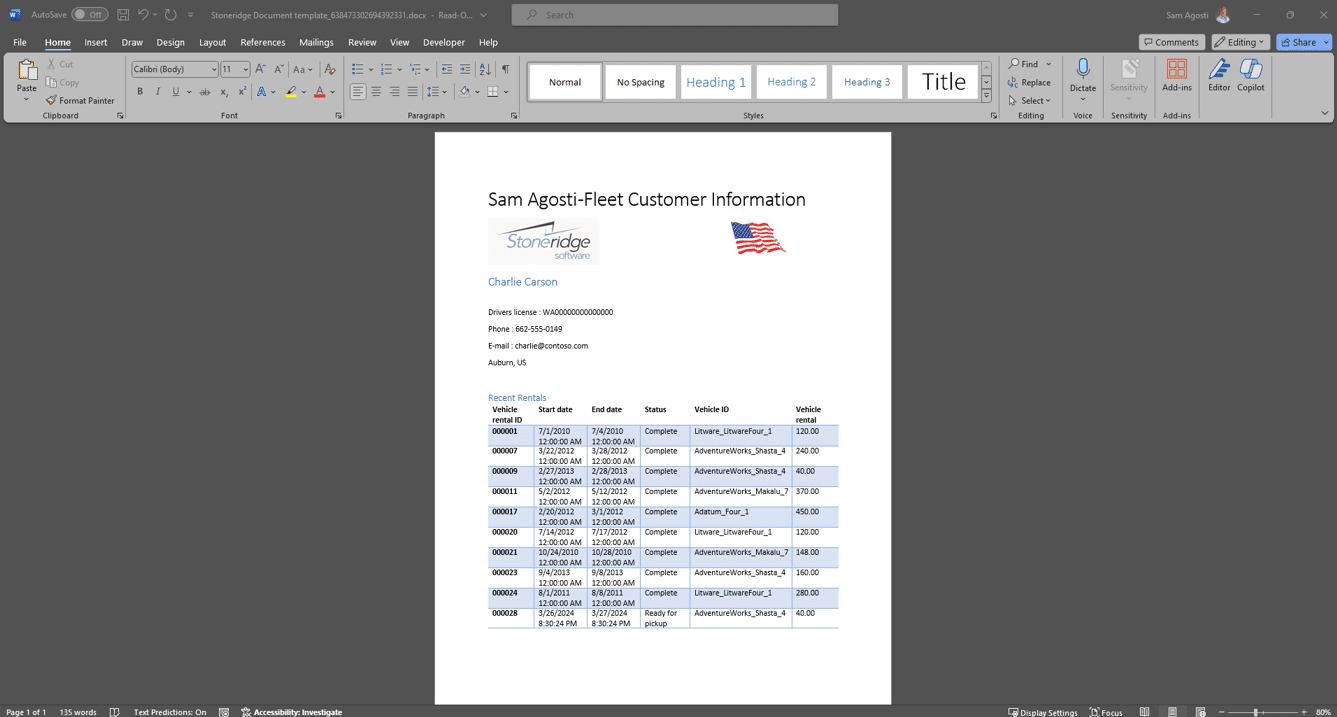

Creating and using document templates in Dynamics 365 Finance and Operations is an efficient way to generate standardized documents populated […]

When looking at software for distributors, it’s important to find something that prepares you for sudden changes in the industry […]

It’s our mission to help clients win. We’d love to talk to you about the right business solutions to help you achieve your goals.