If you use Microsoft Dynamics NAV software to run your small to medium-sized business, you know you have a powerful enterprise resource planning (ERP) solution. But for a Dynamics NAV deployment to be truly successful, you need to make sure you have the best implementation partner possible.

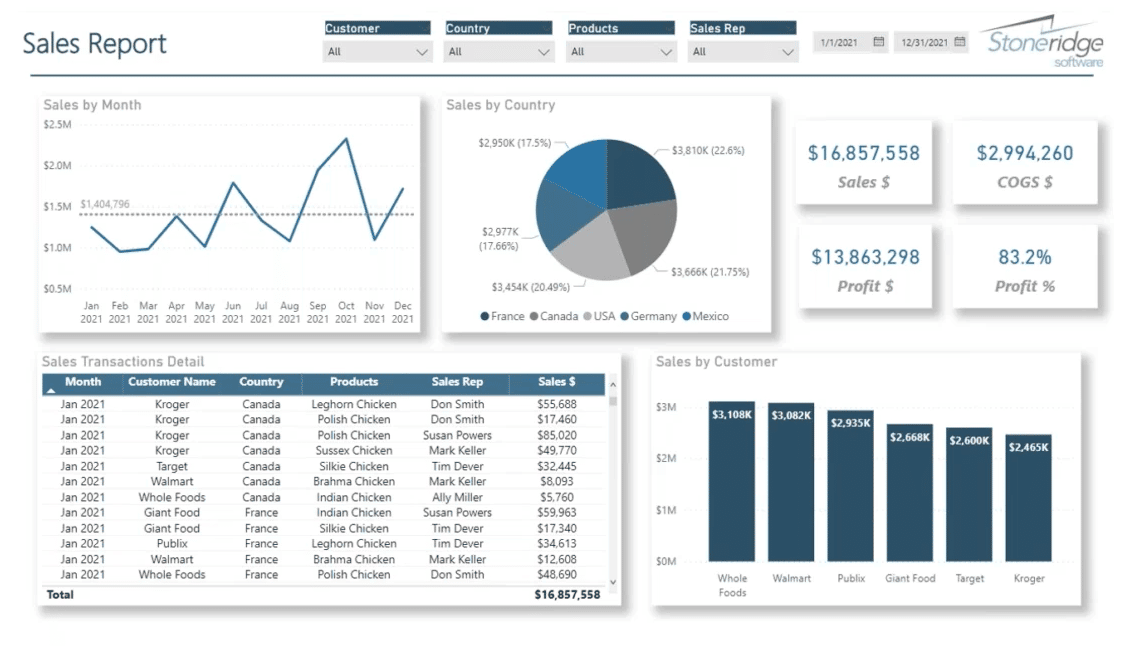

At Stoneridge Software, our deep knowledge of Microsoft (MS) products—and of the Microsoft Dynamics family of products in particular—has earned us Microsoft Inner Circle and 2022 US Partner of the Year status.

When you choose Stoneridge as your Dynamics NAV implementation partner, we’ll stay with you from the time we first meet to discuss your company’s needs to beyond your go-live date, ensuring that your users take full advantage of your system and that it evolves as challenges come and go and your business grows.

No matter where you are in terms of adopting or using NAV software or exploring an upgrade to Dynamics 365 Business Central, we provide guidance, migration and implementation services, training, and more.

Reach out to us today to talk about how to best leverage your investment in Dynamics NAV and how Stoneridge can serve as your partner.

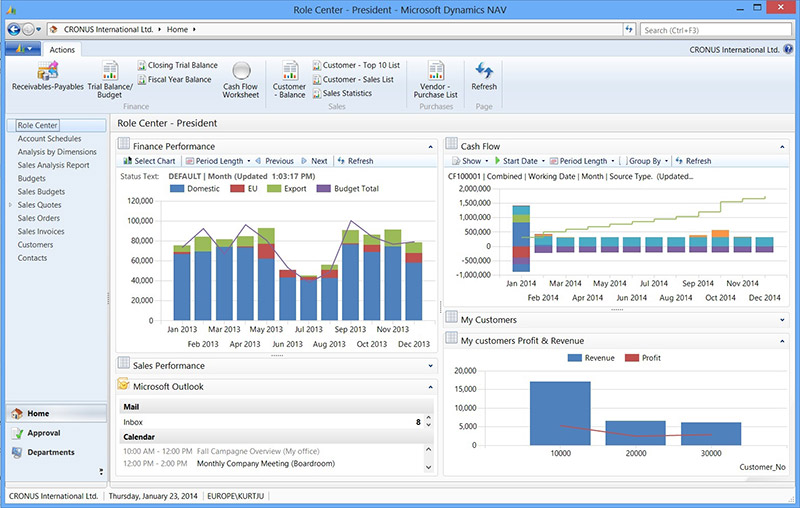

Example of Microsoft Dynamics NAV role center dashboard.

Microsoft NAV ERP Solution

Microsoft NAV is a modular, flexible, and scalable ERP solution for small and medium-sized companies that provides unprecedented insight into your business operations by integrating the software systems that power your various departments. Use it to hone or automate your processes, boosting efficiency and productivity; or, use it to stay ahead of the competition by spotting trends and anticipating challenges.

You can choose the software modules that fit your industry and needs and work with a Dynamics NAV implementation partner like Stoneridge to best leverage the application.

Whether your NAV business solution is installed on-premises or hosted in the cloud on Microsoft Azure servers, it can scale with you as your business grows—simply add users or modules as needed. And in addition to the deep coordination of its ERP modules, MS Dynamics NAV also integrates with Microsoft 365 Office applications.

Who Uses Dynamics NAV Software?

Microsoft Dynamics NAV is a popular ERP choice for small and medium-sized businesses, especially those in the manufacturing and wholesale/distribution sectors.

What might prompt a business to adopt a Microsoft NAV ERP solution?

- A growing business has more and more data to manage, and out-of-the-box accounting software and spreadsheets can’t keep up. A scalable ERP like Dynamics NAV meets their current needs and can grow alongside the business.

- Your business might have more advanced systems in place, but they’re from different vendors. Supply chain data, sales data, and financials never interact, and executives can’t get a clear overview of the company’s operations. An integrated ERP solution like Microsoft Dynamics NAV changes that.

Reasons You May Have Chosen Microsoft Dynamics NAV

- It’s highly configurable; we can customize it to meet your unique business requirements.

- It’s familiar—Microsoft Dynamics solutions have a similar look and feel. The familiar interface translates into faster user adoption and a higher level of proficiency from day one.

- It’s role-tailored to give your users relevant insights for their daily work.

Microsoft Dynamics NAV Capabilities

NAV software covers the following essential business functions:

- Financial management

- Business intelligence

- Sales and marketing

- Fulfillment

- Purchasing

- Inventory management

- Supply chain management

- Project management

- Service management

- Warehouse management

- Manufacturing

Microsoft Dynamics NAV vs. Microsoft Navision

Microsoft Dynamics NAV began its long product journey as an accounting program created by a small Danish company. After a few iterations, it was named Navision. By 2002, Navision had grown enough to catch Microsoft’s eye—the tech giant bought Navision for $1.3 billion.

From 2002 until 2005, Microsoft kept the name Navision, but in 2005 the software was rebranded to Microsoft Dynamics NAV. The last NAV version to be released was NAV 2018.

Microsoft Dynamics NAV Is Now Dynamics 365 Business Central

In 2018, Microsoft rebranded the cloud-based versions of the Dynamics family of products to Microsoft Dynamics 365. The cloud-based version of Microsoft Dynamics NAV was renamed Microsoft Dynamics 365 Business Central.

Continue reading to learn more about the upgraded capabilities in Dynamics 365 Business Central.

Stoneridge Software Can Help Update Your NAV Software

Stoneridge Software consultants were early adopters of Dynamics 365 and have helped many businesses make the transition from Dynamics NAV to D365 Business Central. But from the beginning, we built our business around helping companies implement Dynamics NAV, AX, GP, and CRM. We’re happy to support your older NAV deployment, keeping your NAV accounting software and other applications running until you’re ready for a change.

When you’re ready to take advantage of the updated features in Dynamics 365 Business Central, reach out to Stoneridge for help with the transition.

If you’re running a NAV version from 2013–2017, keep in mind that Microsoft will be phasing out support for these products. Support for NAV 2013 ended on January 10, 2023. As support is phased out, it will be increasingly difficult to ensure that your data remains secure.

Talk to Us About Supporting Your Dynamics NAV Solution or Upgrading to Dynamics 365

Dynamics 365 Business Central Upgraded Capabilities

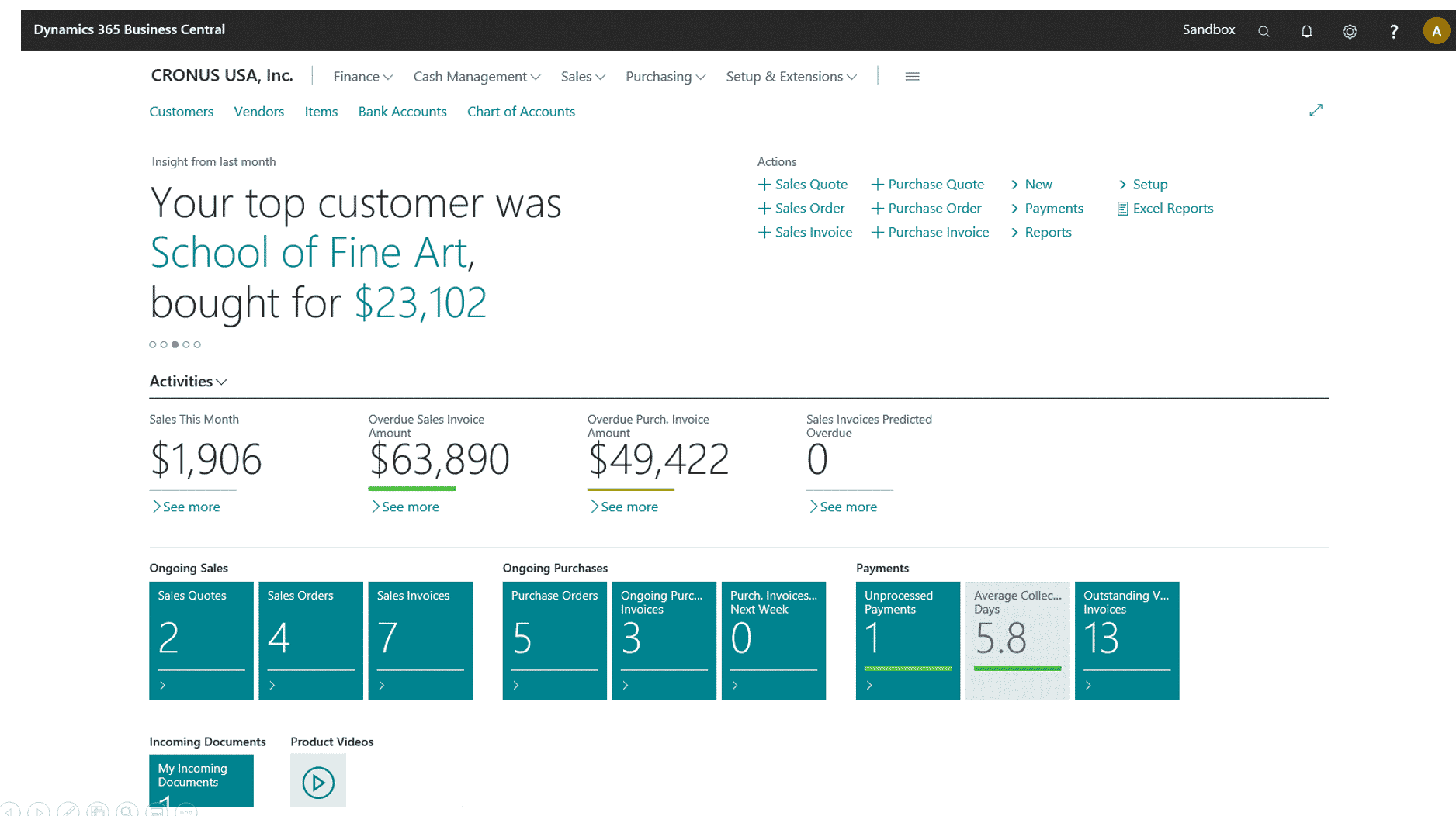

Microsoft Dynamics NAV’s core functionality is maintained in Dynamics 365 Business Central, so you can continue to enjoy all the benefits of NAV when you upgrade to Business Central. However, there are some fundamental differences between the two, and Business Central does have upgraded capabilities.

First, one big change in Business Central is that it’s a subscription-based software-as-a-service (SaaS) product. What does that mean for you?

- The SaaS model takes some of the workload off of your IT team—no more individual installations and upgrades. You simply add users, and the software runs in an internet browser.

- The SaaS model comes with less stringent hardware requirements, because the software isn’t installed as a desktop client. Plus, you can deploy mobile apps for employees to use on tablets or smartphones.

- Instead of yearly upgrades, Microsoft rolls out feature updates for Business Central twice a year and security patches and bug fixes are released regularly.

Although you can still create an on-premises implementation of Business Central, Dynamics 365 is a cloud-native suite of applications. Perks of Business Central as a cloud-based ERP solution include:

- Server rooms and related real estate and utility expenses can be eliminated. Plus, you can free up your IT team to focus on business-related issues rather than IT infrastructure.

- Cloud-based Dynamics 365 implementations are easier than ever now that you can host them on Microsoft’s out-of-the-box public cloud on Azure. You can also host on a private Azure-based cloud.

- Cloud implementation with Azure makes security, backup, and disaster recovery a breeze.

Other new and upgraded Business Central features include:

- Support for third-party extensions. Third-party add-ons can give you ready-to-use capabilities specific to your industry or niche.

- An updated interface with new options and no-code editing of pages and fields.

- Deep integration with the Microsoft family of products, including Microsoft Power Platform and Microsoft 365 Office applications.

And if you need customer relationship management (CRM) features beyond those included in Business Central, you can connect your ERP solution seamlessly to Dynamics 365 Customer Engagement (CRM).

Dynamics NAV Support and Updates With Stoneridge Software

Microsoft Dynamics NAV gives small and medium-sized businesses like yours complete control over core business processes, the precision to perfect your supply chain, and the insight employees need to perform at their best.

Membership in Microsoft’s Inner Circle already recognizes Stoneridge as being among the top 1% of Microsoft Partners. Even more, we’re the US Partner of the Year for 2022. Our expert staff will keep your Dynamics NAV software running for as long as you want to run it, and when you’re ready to upgrade to Dynamics 365 Business Central, we’ll be there to help with that, too.

Sign up for our newsletter today and stay up-to-date with what's new at Stoneridge Software, our upcoming events, and the latest in the business technology industry.

Reach out to Stoneridge today to talk about your Microsoft Dynamics NAV needs.

Subscribe NowStart the Conversation

It’s our mission to help clients win. We’d love to talk to you about the right business solutions to help you achieve your goals.